However, I chose to make my register this way because your bank calls payments debits and deposits credits so I find this less confusing. Admittedly, this is the opposite of what you would do if you were an accountant for a company using the double entry method.

Later, when you are trying to figure out if Mrs. If you have a deposit from multiple people, write out all of their names and the amounts. No one ever regrets having too much documentation. Since it is a spreadsheet, and not a paper ledger, you can type as much as you want here. Description – At the least, use this field to specify the payee for amounts going out and the payor for deposits coming in.

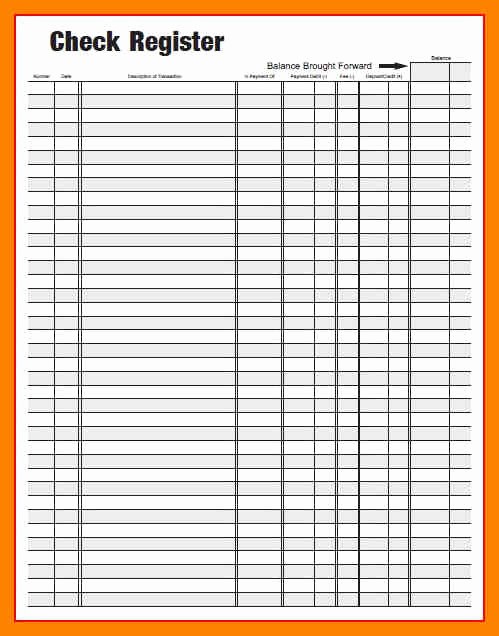

You put an asterisk (or any other symbol) here when you see that the deposit or payment cleared the bank in the month in which you are performing your reconciliation. Cleared – This is the column that you use when you do your monthly reconciliation.You can use it simply for the checks that you still write, or you can be more creative with it and put confirmation numbers in it for online payments. Presently, many are ACH’s or payments made directly from a bank’s website. 15 years ago, most payments coming out of a checking account would have been from paper checks. Check Number – This field is perhaps a bit outdated.This time lag creates the need to reconcile the account monthly. Note that this date does not always correspond to the date on which the transaction is posted to your bank account. Date – The date you made the deposit, wrote the check, etc.Type the following values in cells A1 through A7.

0 kommentar(er)

0 kommentar(er)